Gifts in a Will and Gifts by Beneficiary Designation are two easy ways to make gifts that will have an impact for those in need for generations to come — and they don’t cost anything now.

Did you know that you can share our global cause to end poverty and enrich millions of lives – by simply signing your name?

When you include the Heifer Foundation or Heifer International in your planned gifts, you sow a legacy of hope and help. You cultivate the future for communities around the world being served by the tireless work of Heifer International – work that is bringing dignity to the disadvantaged and forging the kind of self-reliance that reverses a generational cycle of impoverishment.

Once your family and friends are provided for, we hope you consider making Heifer Foundation’s support of Heifer International part of your life story with a generous legacy gift.

Gifts by Beneficiary Designation

You can help sustain our life-changing work for years to come when you name Heifer as a beneficiary of your retirement account, life insurance plan, bank account or other assets. It is one of the easiest gifts to give – it costs you nothing now, does not require an estate plan or lawyer, and you can change your beneficiaries at any time.

You may wish to update your beneficiary designations after:

- You marry, divorce, remarry, or become widowed.

- Your primary beneficiary passes away.

- Your financial institution changes ownership.

- You have a grandchild or great-grandchild.

- You want to leave a legacy gift to the Heifer Foundation.

Potential benefits of gifts by beneficiary designation:

- Reduce or eliminate taxes on retirement assets

- Reduce or avoid probate fees

- No cost to you now to give

- Create your legacy with Heifer Foundation

How to Change a Beneficiary Designation:

Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

Follow the links to change your beneficiary or fill out the form.

Be sure to spell the name of our organization properly:

HEIFER FOUNDATION

Include our tax identification number: #71-0699939

Save or submit your information online or return your Change of Beneficiary Form.

What Kinds of Gifts Can You Give?

You can donate a number of assets through a beneficiary designation. You will provide for the future of Heifer’s global mission to end hunger and poverty and care for the Earth through a few simple asset designations:

- IRAs, 401ks and other qualified plans

- Life insurance policies

- Certificates of deposit

- Bank accounts

- Donor advised fund residuals

- Personal residence

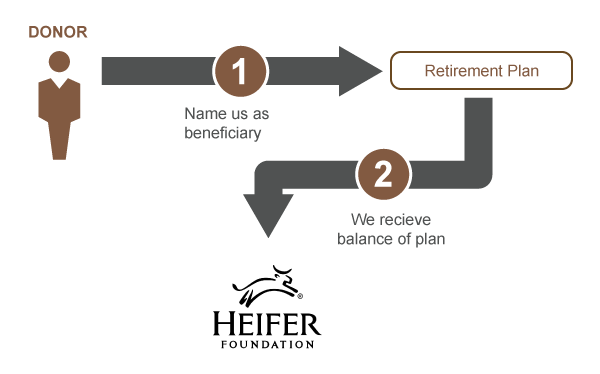

A Gift Of Retirement Funds (Beneficiary Of Your Retirement Plan)

Many people choose to name Heifer as a beneficiary of a retirement plan. Not only can this reduce their taxes, it simultaneously advances the Heifer mission to change the world for communities in desperate need.

Benefits to you:

- Reduce or eliminate taxes on retirement assets.

- Remove highly taxable assets from your estate by direct beneficiary designation.

- Reduce or avoid probate fees.

- There is no cost to you now.

To name the Heifer as a beneficiary of your retirement plan, contact your bank or insurance company to see whether a change of beneficiary form must be completed.

A Gift Of Funds Remaining In Your Bank Accounts, Brokerage Accounts Or Certificate Of Deposit (CD):

Naming Heifer as the beneficiary of a certificate of deposit, a checking or savings bank account or a brokerage account is one of the easiest ways to bring life-giving solutions to struggling communities which are committed to finding a path of sustainable self-reliance.

Donor-Advised Fund (DAF) Residuals:

Final distribution of contributions remaining in a Donor Advised Fund is governed by the contract you completed when you created your fund. We hope you will consider naming Heifer as a “successor” of your account or a portion of your account value.

Savings Bonds:

If you have bonds that have stopped earning interest and that you plan to redeem, you will owe income tax on the appreciation. In the end, your heirs will receive only a fraction of the value of the bonds in which you so carefully invested. Since Heifer Foundation and Heifer International are tax-exempt institutions, naming us as a beneficiary means that 100 percent of your gift will go toward ending hunger and poverty here at home, and the world over.

Life Insurance Policy Gift:

If you have a life insurance policy that has outlasted its original purpose, you can use it to fund a legacy gift while also enjoying tax savings during your lifetime.

Benefits to you:

- Donate ownership and receive a charitable income tax credit for the market value of the policy.

- Receive additional tax benefits by making annual gifts so that we can pay the premiums.

- If you retain the policy and name us as beneficiary, the proceeds of your policy will be paid to the Heifer Foundation, and your estate will receive the tax credit from the charitable gift receipt.

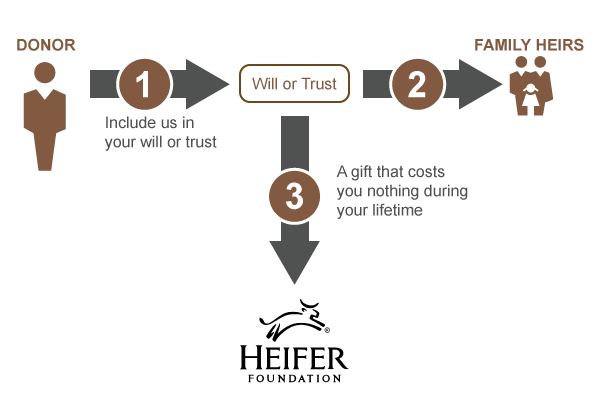

Gifts in a Will

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a difference for communities around the world.

Here are the ways that most people make a lasting impact with Heifer:

Residual bequest: a percentage of the remainder of the estate after other specific legacies have been fulfilled.

Specific bequest: a specific dollar amount or stated fraction of the estate or a specified gift in kind (collections, art, books, jewelry, and so on).

Contingent bequest: a gift that is originally intended for other beneficiaries but, in the event of their prior passing, is redirected as a charitable donation.

A gift in your will is one of the easiest ways to create your legacy.

Benefits include:

- NO COST: It costs you nothing now to give in this way.

- FLEXIBLE: You can alter your gift or change you rmind at any time and for any reason.

- LASTING IMPACT: Your gift will create your legacy with Heifer Foundation.

4 simple, “no-cost-now” ways to give in your will:

General Gift

Leaves a gift of a stated sum of money in your will or living trust. For example, you might decide to leave each of your favorite charities $10,000. It’s considered to be ‘general’ because it doesn’t specify from where the money comes.

Residual Gift

Leaves what is left over after all other debts, taxes, and other expenses have been paid.

Specific Gift

Leaves a specific dollar amount, percentage, fraction, or specific items (collections, art, books, jewelry, and so on).

Contingent Gift

Leaves a stated amount or share only if a spouse, family member or other heir/beneficiary does not live longer than you. In other words, your gift is contingent upon whether or not they survive after you.

Complimentary planning resources are just a click away!

Easy Ways to Make a Lasting Impact

Gifts That Cost You Nothing Now

Gifts That Reduce Your Taxes

Gifts That Pay You An Income

Gifts That Make An Impact Now

Need assistance? I'm here to help!

Debbie McCullough

Vice President of Planned Giving

888-422-1161 x 4922

legacyinfo@heiferfoundation.org